You're online shopping and you see an option to add an extended warranty or protection plan on your product. You hover over the add-on button or checkbox, trying to decide if the extended warranty is worth the cost.

Chances are you've experienced this before. And if you're like most shoppers, you've probably decided to go for it with some purchases but not others. Here's the truth: sometimes warranties aren't worth it. It all comes down to what you're getting and what you're paying for it. What you want to avoid is a warranty plan that is:

high cost (more than 15-20% of the product value) for a short plan and limited coverage.

That's where Mulberry Unlimited comes in. When you subscribe to Mulberry Unlimited, you'll get coverage for all your online purchases under the same product protection plan for just $9.99 a month. That means unlimited coverage and unlimited claims, with no deductibles or hidden fees.

When are warranties not worth it?

As a customer, it’s a hard call to make. We found in our customer research that the two biggest concerns for customers for warranties are cost and coverage.

You know the cost of your purchase, and having to predict whether you might have an accident, damage, or malfunction while you’re at checkout can be difficult. Product protection is meant for those unexpected and unanticipated disasters. But you don’t want to pay an arm and a leg if the coverage is overpriced.

Companies can price gouge by making you pay high amounts for a short plan that doesn’t cover much. By offering only one protection option, companies can take advantage of you by making you pay obscene prices.

If you are paying 30% of the cost of the product just to see if it will last for another 2 years without malfunctioning, then you’re getting ripped off.

When warranties are worth it?

Extended warranties, also known as product protection plans, are an add-on choice that customers have on products.

Warranties can be a big money saver when a product malfunctions, gets damaged, or breaks. It can mean fixing or replacing rather than spending the money to purchase a new product.

We found in our customer survey that 61% of people get electronics warranties for personal or school devices, and 32% of people think warranties are a necessity if the item cost is over $200.

This can be a big deal for expensive or fragile products. People can get protection on everything from glass that will get replaced if broken to a bike that gets fixed if malfunctions or wears out after the manufacturer warranty, to furniture.

How can you avoid getting ripped off?

Unfortunately, there are companies that will rip you off when it comes to product protection. Here's how you can guard against it:

Comparison shop

Companies will offer one protection option at checkout, and that makes customers think that it’s the cost to cover that product. But in reality, companies are paying a lot of people in between.

The MulberryCare Chrome extension makes it easy to compare protection plan costs because it can show you a side by side option with your come up in your browser to show you what a plan can look like.

If you can find a cheaper plan than us, we’ll match your price.

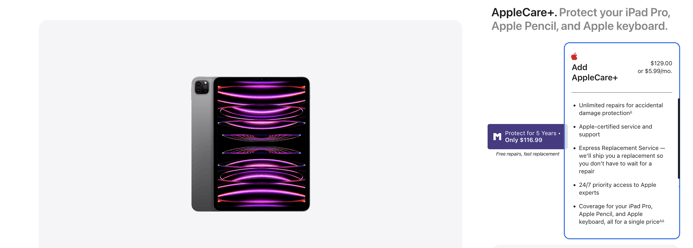

AppleCare+ 2-year plan: $129

MulberryCare 5-year plan: $116.99

If you decide you want to upgrade to a longer length plan, you will have that option within 30 days of purchase - and you can check that plan against the price on the site.

Read the terms

If companies aren’t listing specifically what is covered, or make you go read a complicated list with confusing terms, then the coverage isn’t that great, and maybe not what you really want.

If the terms are hidden, then they have something to hide.

You want to be protected from everyday things. Everyday things can be communicated in everyday language. If it’s not, that’s an indicator that it’s not covering the things you want.

They might also try to load you with fees - by using the warranty you already paid for, you now have to pay an additional charge just to use it.

What you should be paying per item

With different product types, different things are covered, for different lengths of time, and they have different costs. Comparing a furniture warranty plan with a phone warranty plan becomes an apples and oranges comparison deal. It might mean that you think you’re getting a great deal for the percentage of the product cost that it represents, but actually, the warranty isn’t worth the cost.

If you want coverage for everything, subscribe to Mulberry Unlimited. When you have product protection for all your items, you're able to worry about the things that actually matter. Get the ultimate peace of mind with a Mulberry Unlimited subscription.