Marketplaces like Amazon and category giants like Best Buy and Wayfair have raised awareness of the value of extended warranties and accidental damage protection for their customers’ purchases for many years.

Even before online shopping, retailers who sold mattresses, furniture, and electronics were early adopters of product protection plans, mainly as an additional revenue stream. Fast-forward to the present, and retailers have found that consumers are open to the concept of product protection plans on almost any type of durable goods. Other categories that are rapidly gaining traction include smart home fitness, bicycles/e-bikes/scooters, home decor, jewelry, luggage, small appliances and even tires.

Factors customers consider for product protection

What consumers consider a relevant product for product protection is subjective, and largely tied to the individual wants and needs of the shopper. This is why it’s important to consider what motivates consumers to buy protection.

Consumers think about a number of things while they’re deciding whether to purchase product protection. These factors fall under two large umbrellas: pricing and lifestyle considerations. Let’s take a closer look at the factors for both.

Pricing considerations

Price is almost always the primary consideration for customers. The price of the protection plan and the specific coverage details have to be perceived as a good value when compared to the price of the primary purchase.

Do I feel like this purchase is an “investment,” or more of a casual purchase?

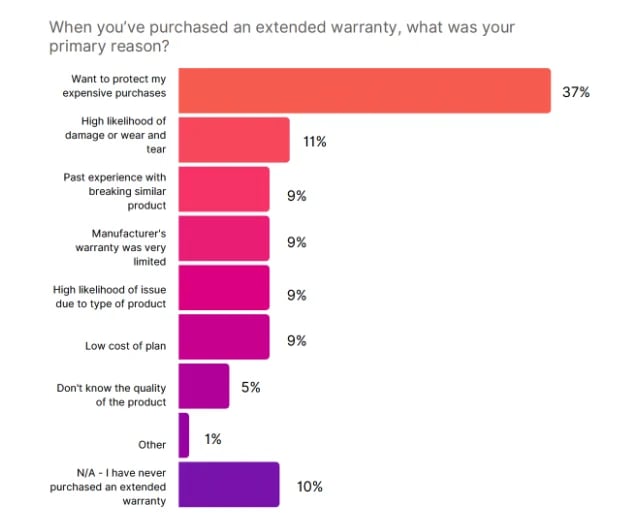

In our study, we found that most shoppers buy protection because they want to protect their expensive purchases. The higher the price of the product, the more relevant product protection offers become.

But in addition to the considerations around the price of the product is the intent customers have for it when they purchase it. For example, many shoppers may add product protection to a $100 item purchase that they plan to use for many years—even though the item is less expensive, they have a long anticipated use time. Whether someone’s spending $1,000 on a scooter, $1,500 on a sofa, or $100 on a cleaning device, what the purchase means to the customer is nearly as important as the price of the product when it comes to product protection.

Can I afford the protection plan in addition to my primary purchase?

Often, customers coming in aren’t planning to make a product protection purchase and haven’t factored that into their overall budget. If they see the option to purchase a plan at the time, they’re going to make a quick assessment of the cost/benefit as it relates to their original budget.

Does the protection plan price seem reasonable compared to what I’m spending on the product?

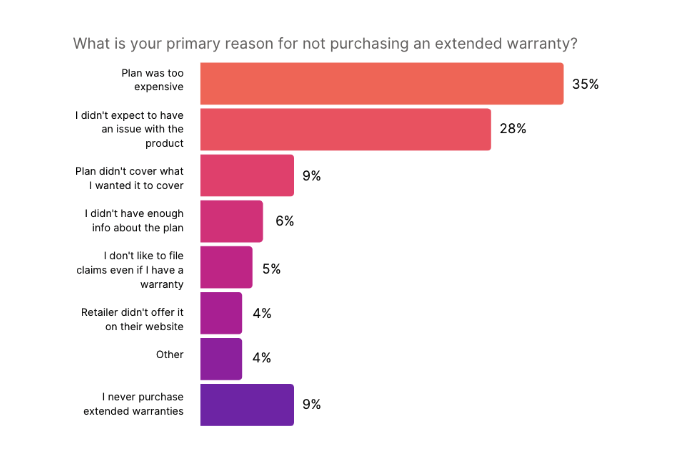

With a plan that’s too expensive, price will be a non-starter for customers even when they want to protect an expensive product, and the coverage details are compelling.

For a positive customer experience it’s preferable to optimize for attachment rate rather than earning a large profit on infrequent sales. Fairly priced product protection can help create a level of trust with a broad cross-section of shoppers, which contributes to improved conversions and long term retention rates.

Would having to make an unexpected major repair or replacement be financially stressful?

This consideration is especially relevant when buying an appliance or electronics, as both categories include expensive products which are used daily and therefore need to be dependable.

If having to make an expensive repair or replacement would be a hardship to a shopper, a relatively inexpensive product protection plan may have a strong appeal.

Lifestyle considerations

The other set of factors customers consider is related to their lifestyle, their household makeup and how well they care for their belongings.

Have I had a history of accidental damage with my belongings?

Some people are accident prone or have families that are really hard on their purchases. Customers often use past experience with similar products to evaluate whether they want to add protection to their purchase.

Am I typically an occasional or frequent user of this type of product?

Occasional users are likely to be less motivated to get protection when they don’t expect the item to get as much use.

Will others (e.g. family members, pets) also be using this item?

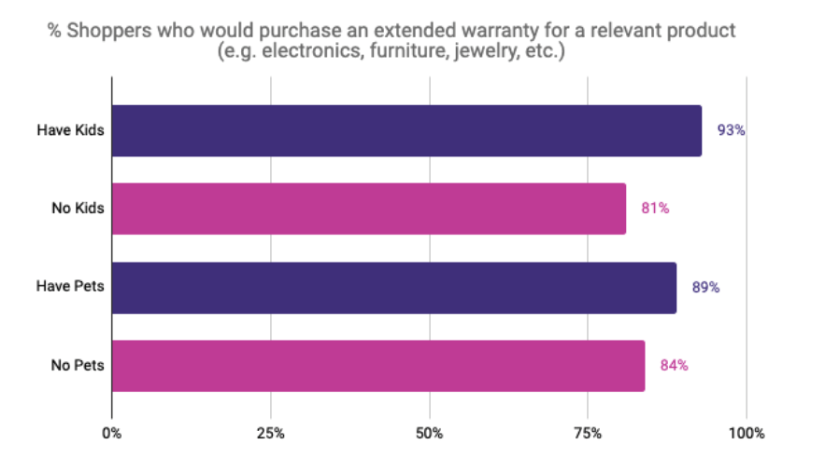

In our survey, we found that shoppers with kids or pets are more likely to buy product protection.

Do I anticipate additional children, and over what time period?

One common example of this is with baby and children’s products. Raising a family is expensive—customers will consider their plans for additional children, and will have concerns about how long their product will last. If adding product protection onto a baby mattress, a crib or stroller means they can get it to last through multiple kids, it’s worth it to invest in a protection plan.

Will I rely on this as part of my daily routine for health or well-being?

This is a really significant factor, more so than convenience or enjoyment. A growing category for product protection is health and wellness gadgets. Customers will want to know they can rely on a product which is a key part of their daily routine.

Am I likely to become sentimentally attached to this item?

People get sentimentally attached to certain items. Furniture is often one of these; especially when people buy a sofa or armchair that is very comfortable and fits in beautifully in their home, they can get emotionally attached there.

Within lifestyle considerations, these things customers think about include reflecting on their history, current day-to-day, and future when envisioning the role the product will play in their life.

Use these factors to understand your customer segments

While there are some products in ecommerce that have long been associated with product protection, the potential for new categories is rapidly expanding.

Now is the time for ecommerce retailers to consider what product categories drive their businesses, and whether they should address the needs of their customers with product protection offerings. When you understand the factors that customers consider when buying product protection, you can look at your customer segments to see how product protection is relevant to them.

This is based on highlights from our webinar, How Warranties Affect Online Shopper Behavior. For more, watch the full webinar recording.